The Maritime Boundary

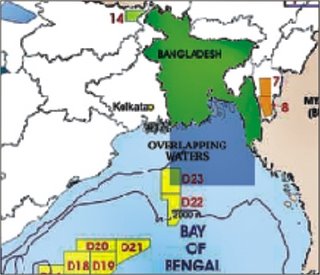

Of late, I have come across the Oil and Gas blocks contentions between India and Bangladesh. The blocks which India put for auction in NEPL-VI, are actually overlapping Bangladesh blocks. The region is alleged to be 'overlapping' between India and Bangladesh EEZs. So, who's area is it?

EEZ

Generally a state's EEZ extends to a distance of 200 nautical miles (370 km) out from its coast. But what happens when one country's 370kms go inside the other? According to the United Nations Convention on the Law of the Sea - Part V, any such disputes between any two countries should be resolved on the basis of equity and in the light of all the relevant circumstances, taking into account the respective importance of the interests involved to the parties as well as to the international community as a whole.

India & Bangladesh Maritime Boundary

According to the articles(first and second) published in The Daily Star, the Bangladesh govt. claims that anything falls under the 370km zone from their coast line, should be given as EEZ of Bangladesh. The argument considers Bangladesh as a geographically disadvantaged country because its 720-km coastal line is concave in shape. Also, Bangladesh must have an open wide front to the high seas in the Bay of Bengal. The Author quotes the historical judgement given by ICJ (International Court of Justice) in NORTH SEA CONTINENTAL SHELF CASE (1969) and said that Germany got the access to North Sea despite the equidistant line did not allow them to get so. The judges allowed Germany to be considered 'equitably', so that they also gets some EEZ across North Sea. Harun ur Rashid also added that equidistant method (suggested in Geneva Convention - article 6) should be considered only between opposite States, like India and Srilanka.

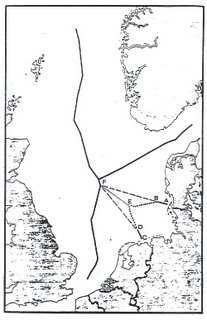

North Sea Continental Shelf Case

Point C marks the land boundary between the Netherlands and Germany. Point A marks the land boundary between Germany and Denmark. The line C-D-E-B-A is the approximate equidistance line.

Point C marks the land boundary between the Netherlands and Germany. Point A marks the land boundary between Germany and Denmark. The line C-D-E-B-A is the approximate equidistance line.History

India and Bangladesh started their bilateral talks way back in 1974, which was inconclusive. India was looking for equidistant border where Bangladesh was for equity based boundary. The same difference in arguments rendered Bangladesh-Myanmar talks inconclusive as well. But, India and Myanmar (opposite States) agrred upon equidistant boundary.

Maps : Indian/Myanmar claim

Maps : Bangladesh claim

Maps : Bangladesh claim

My Findings

1) Even if a genuine passage is allowed for Bangladesh, the Oil blocks will be inside Indian area. I am assuming, that a passage is a passage - not a continuation of EEZ to bay of Bengal. In North Sea case, Germany was allowed a passage only.

2) There are other adjascent states who've done their maritime delimitation amicably in equidistance method. For exacmple - Albania & Italy and US and Mexico. The Geneva Convention in 1958 mentions that as a method to determine the maritime boundary.

3) The ICJ North Sea case judgement sets a lot of factors to be considered as benchmarks. Also, it noted that equidistant method can be bypassed only in case of "special circumstances". In those cases, if no concesus arises between the parties then

they were to be divided between the Parties in agreed proportions, or, failing agreement, equally, unless they decided on a régime of joint jurisdiction, user, or exploitation.4) The Maritime Boundary case (ICJ, 2002) judgement dismissed Cameroon's claim to get more EEZ from Nigeria under 'equitable' adjustment.

The Arguments were like these :

The Court notes in this respect that Cameroon contends that the concavity of the Gulf of Guinea in general, and of Cameroon’s coastline in particular, creates a virtual enclavement of Cameroon, which constitutes a special circumstance to be taken into account in the delimitation process. Nigeria, for its part, argues that it is not for the Court to compensate Cameroon for any disadvantages suffered by it as a direct consequence of the geography of the area. It stresses that it is not the purpose of international law to refashion geography.The judgement notes :

This method (equitable), which is very similar to the equidistance/special circumstances method applicable in delimitation of the territorial sea, involves first drawing an equidistance line, then considering whether there are factors calling for the adjustment or shifting of that line in order to achieve an "equitable result"....The Court’s jurisprudence shows that, in disputes relating to maritime delimitation, equity is not a method of delimitation, but solely an aim that should be borne in mind in effecting the delimitation....The Court finds that although it does not deny that the concavity of the coastline may be a circumstance relevant to delimitation, it nevertheless should stress that this can only be the case when such concavity lies within the area to be delimited. It notes that the sectors of coastline relevant to the present delimitation as determined above exhibit no particular concavity....Having further concluded that there were no other reasons that might have made an adjustment of the equidistance line necessary in order to achieve an equitable result, the Court decides that the equidistance line represents an equitable result for the delimitation of the area in respect of which it has jurisdiction to give a ruling.Clearly, Bangladesh does not have concavity to the extent of Cameroon. Hence, getting favourable judgement from ICJ would be very difficult for them.

5) The outcome of a running case would be very interesting in this perspective. The case between Romania and Ukrine not only resembles India-Bangladesh case, but also has a high stake.

Solution

Basically, India or Bangladesh govt are not willing to claim their stakes before the stake is proved to be high. If at all Oil exists in those blocks, the countries may face each other in ICJ, very soon. The other option, i.e. joint exploration (as between Indonesia and Australia), is possibly not going to take place. Because, Bangladesh might once more come up with all bilateral issues to link with this one. For hostile neighbours, Court is the best place to solve disputes.

Sources : The following site shows a EEZs for various countries based on existing treaties or Equidistance line.